Top Articles by MoneyFormula: Australia's Best Mortgage and Personal Budget App for the Australian Household!

Beat Your Mortgage: Cut 10 Years off Your Debt in Four Easy Steps!

Your mortgage feels like it's never going down.

Every month you pay on time, but the balance barely moves. And you know the bank's loving it.

You're Paying Way More Than You Should

Banks structure your repayments to maximise the interest over 30 years. The longer you take, the more profit they make - and banks love their profits!

Quick Quiz:

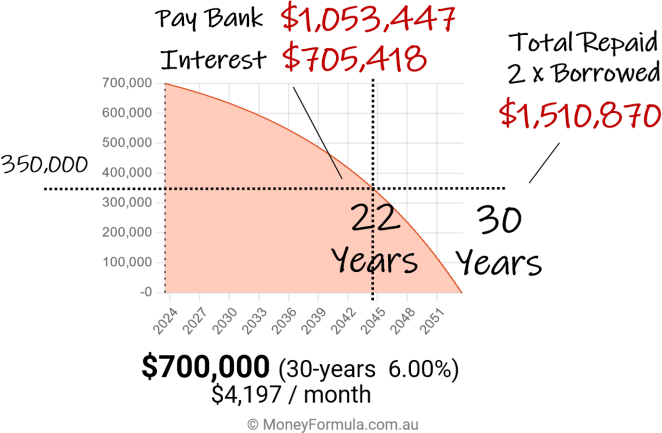

[1] Did you know you will pay back over 2 times the amount you borrow if you don't make extra repayments?

For example, borrow $700,000 at 6.0% and over 30 years you will repay over $1,500,000 back to the bank.

[2] Did you know, after 22 years of repaying your mortgage you will still owe the bank over 1/2 the original amount you borrowed?

For example, on the same $700,000 loan, despite paying back over $1,000,000 in the first 22 years you will still owe the bank over $350,000.

Now, this is not because you have to pay this much — it's because that's how the system's designed and few of us question it.

But here's the thing: a small change in how you manage your money and a slight tweak to your mortgage payments, can cut years off your debt and save you thousands of dollars.

Why Your Budget Always Fails

You've tried the spreadsheets. Downloaded the apps. Cut back on everything.

Nothing's worked.

Traditional budgeting ignores how Aussie families actually get paid and spend. Fortnightly pay. Quarterly bills. Everyone is busy. Life happening. Never any money left over.

It's not about willpower. The system's working against you.

MoneyFormula Is Different

MoneyFormula is the personal finance app for Australian homeowners that helps you take control in four simple steps:

1. Pay yourself first

2. Create a simple budget

3. Choose your debt strategy, and

4. Review your spending.

It shows you exactly how much you can save on your mortgage in 10 minutes. Not theory. Actual numbers based on your mortgage, current balance, interest rate and loan term remaining.

And to achieve it you just prioritise a small amount of your income towards your mortgage, using the Pay Yourself First strategy. It's that simple!

Beat Your Mortgage Example

Bob and Jill had a mortgage, credit cards, a personal loan. Paying everything on time but getting nowhere.

Within 10 minutes of using MoneyFormula, they discovered $73,477 in mortgage savings. Just by making their money work differently.

They went on to lock in and cut 10 years off their mortgage. Total savings? $195,000.

From stressed to in control.

Ready Beat Your Mortgage?

Try the MoneyFormula Four Simple Steps today and discover just how easy it is to take control of your money and crush your mortgage!

MoneyFormula has everything you need to help you review your mortgage, lock in your new mortgage-free date and put you in charge of your finances.

Give MoneyFormula a go today and see what you think.

Special Reports

Top Articles

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

Show Less

PLEASE NOTE: The information in this article is general in nature. It does not take into account your personal objectives, financial situation or needs. Please speak to a qualified financial adviser if you need specific advice on your finances.