Top Articles by MoneyFormula: Australia's Best Mortgage and Personal Budget App for the Australian Household!

Learn How To Beat Your Next Mortgage Interest Rate Rise - Calculate Your Impact Today Before it Hits Your Budget

When the RBA announces another interest rate rise, for Australian mortgage holders it means one thing: your mortgage repayments are going up.

None of us want an interest rate rise, but now that it's here, the next best thing is being prepared before it hits your mortgage.

Unfortunately when the RBA announces a rate rise, most Australian homeowners wait to see what their bank will charge them.

But the difference between financial stress and financial control is as simple as knowing YOUR mortgage repayment increase and the impact it will have on YOUR budget, before the first repayment hits your account.

Calculate your impact right now - and then start reviewing your budget, your income and your spending before it hits.

Don't wait for the bank to pass it on and increase your repayments, by then it's too late.

Let's go through these easy steps you can follow to beat your interest rate rise.

The Impact of a Rate Rise on Your Mortgage

As a quick summary, here's what a rate increase looks like on a 30-year mortgage (approximate monthly increases):

Loan Balance

+0.25% Rise

+0.50% Rise

$400,000

+$60

+$120

$600,000

+$90

+$180

$800,000

+$120

+$240

While the above estimates are a good start, what's important is to know how much your actual repayments will go up with a 0.25% or 0.50% rate rise, so you can start to plan for it.

Unfortunately most Australian homeowners don't know their number, and when the next rate rise is announced, and the bank increases your repayments, it's too late. You're reacting in panic mode instead of planning ahead.

Prepare Now, Not After

Don't wait until the next rate rise is announced.

Calculate Your Rate Rise Impact Today

It's really important to know how much your repayments will go up by, as this is the actual amount of money you will need to find each month.

Your actual increase will be different based on your current balance, loan term remaining, current interest rate, and any offset or redraw balance you may have. That's why you need to calculate YOUR specific situation.

MoneyFormula Mortgage Tracker

You can calculate your number manually using an online mortgage calculator, or if you are using the MoneyFormula to manage your mortgage, your number is one click away.

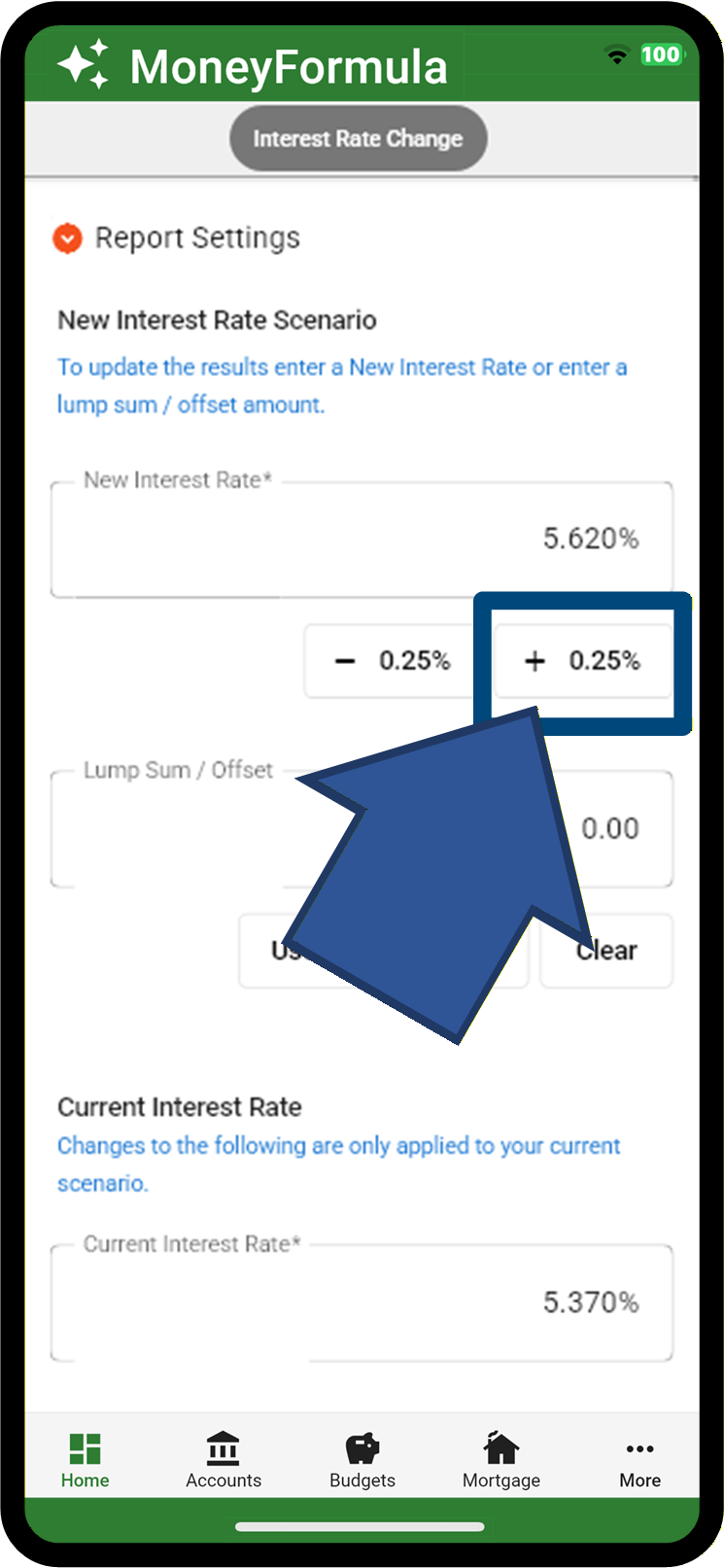

From the Mortgage Tracker, open the interest "Rate Change Report", click on + 0.25% and get an instant comparison between your current repayments and your new repayments.

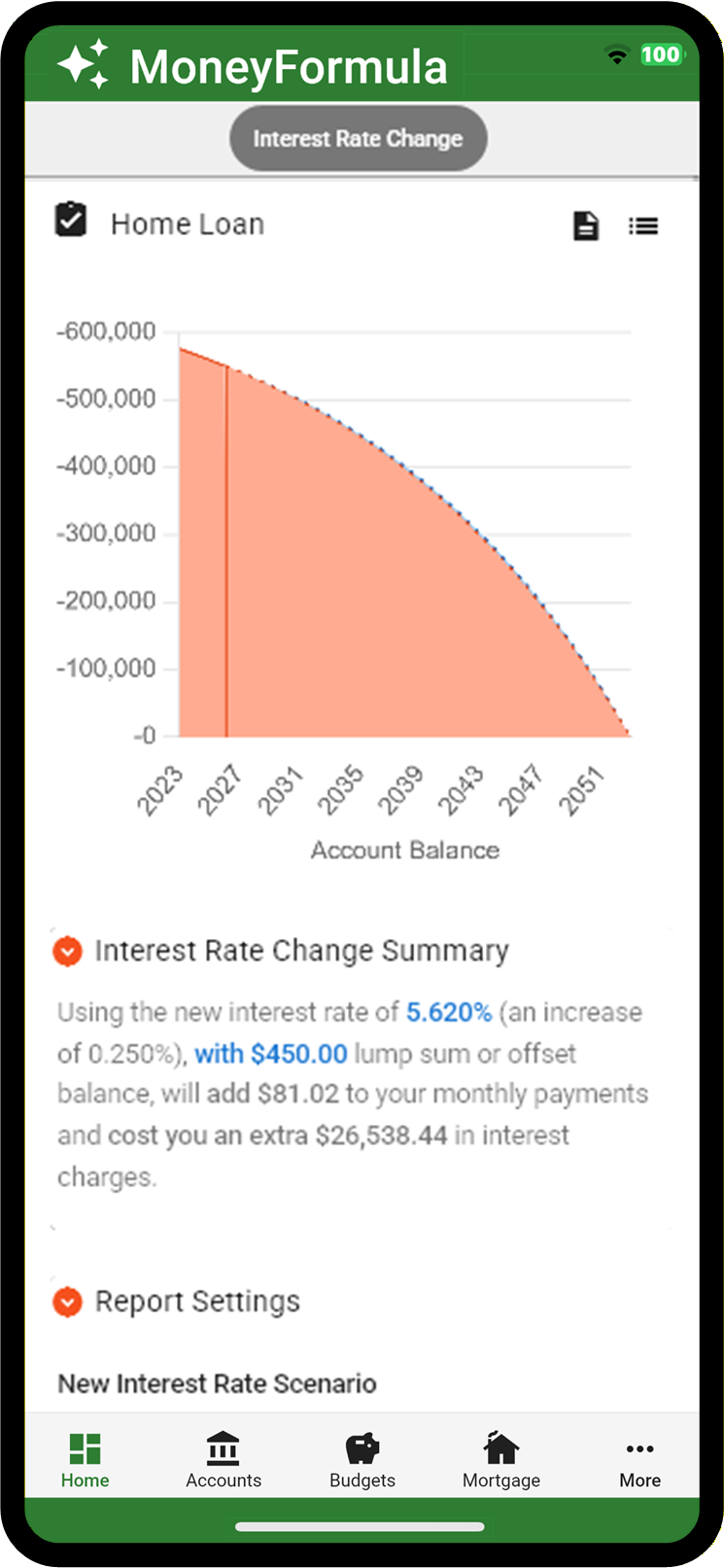

MoneyFormula App - Interest Rate Rise Report - Use the +0.25% to instantly see the impact of rate rises on mortgage repayments.

TIP - If your mortgage changes by other amounts than 0.25%, you can simply enter the new rate that will apply to you.

Summary of the Rate Rise Impact

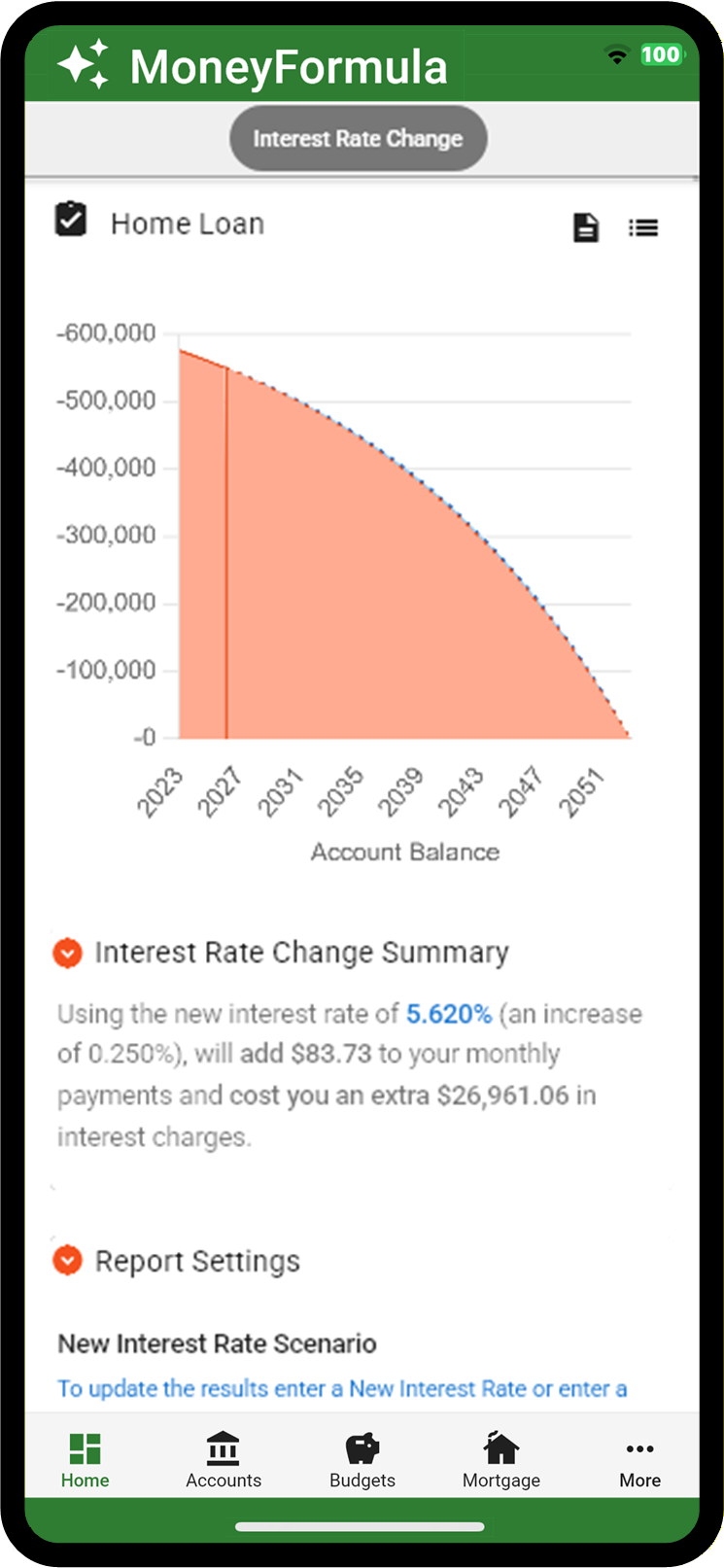

The interest rate rise report will instantly show you a summary of the impact in both a chart and spells out exactly what is going to happen, so you know exactly where you stand.

MoneyFormula App - Interest Rate Rise Report - Get an instant summary of the impact of the interest rate rise on your mortgage.

In the example above we can see that the report is telling us:

"Using the new interest rate of 5.620% (an increase of 0.250%), will add $83.73 to your monthly payments and cost you an extra $26,961.06 in interest charges."

So we now know we need an extra $83.73 a month to cover the impact of the rate rise.

Full Breakdown of the Rate Rise Impact

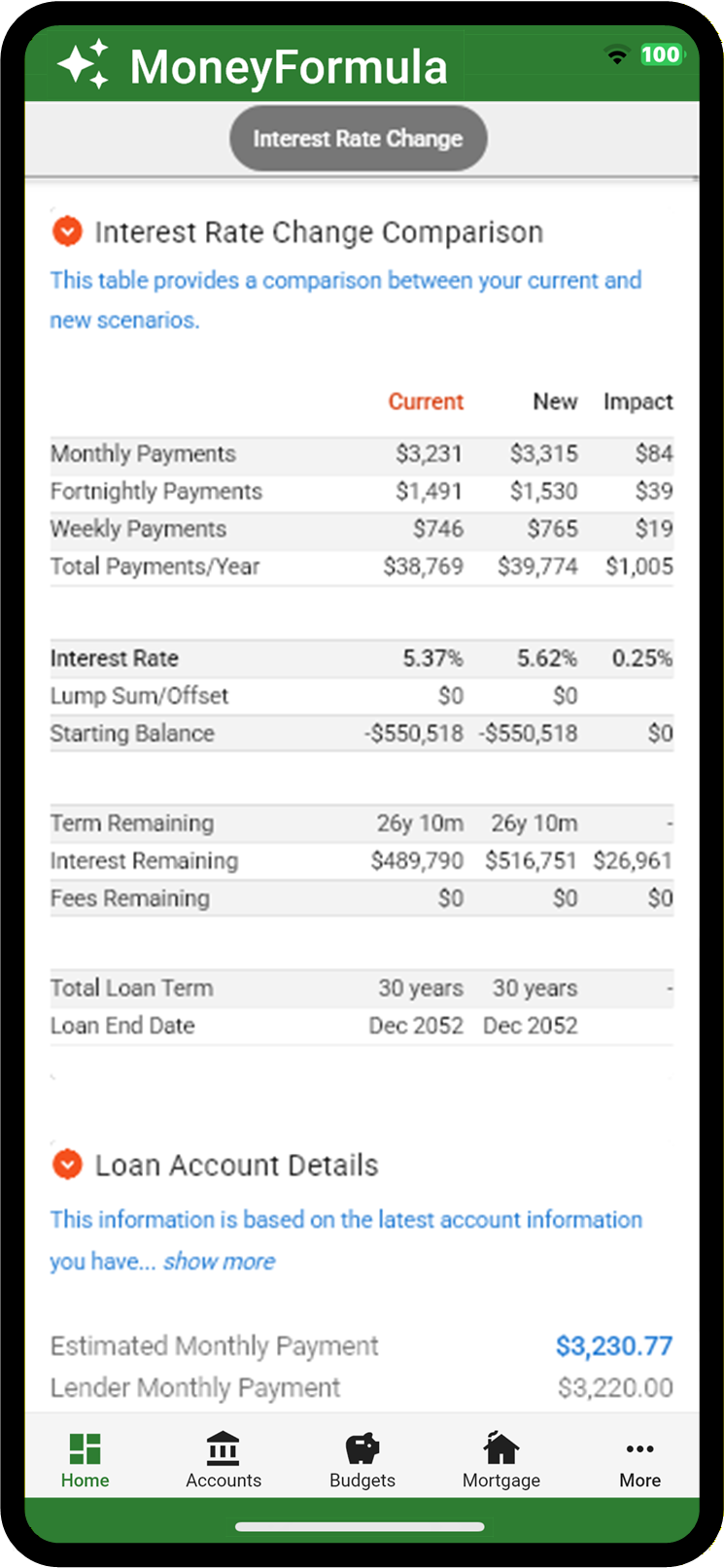

If you want a full breakdown of the impact drop down to the rate comparison table that gives you a complete comparison between the current and new repayment amounts.

MoneyFormula App - Interest Rate Rise Report - Get an detailed comparison of the impact of the interest rate rise on your mortgage.

We can see from the above you now have the full details on the impact on your repayments no matter how you are paying them (monthly, fortnightly, weekly), the total interest impact and so on.

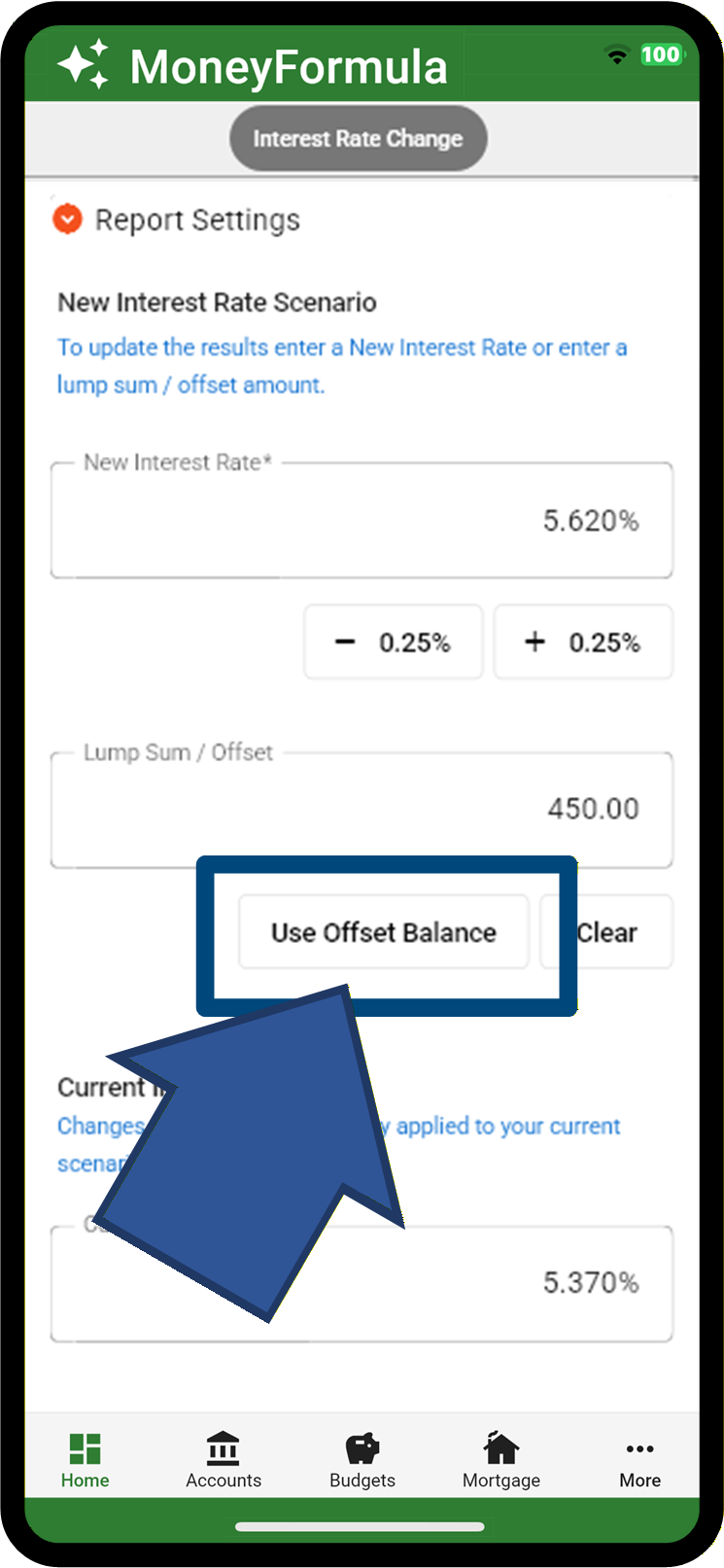

Use Your Redraw or Offset Account

If you have an offset account (or redraw amount), try to build it up before the rate rise comes through.

Every dollar you put into the offset reduces the mortgage balance before the bank calculates your interest.

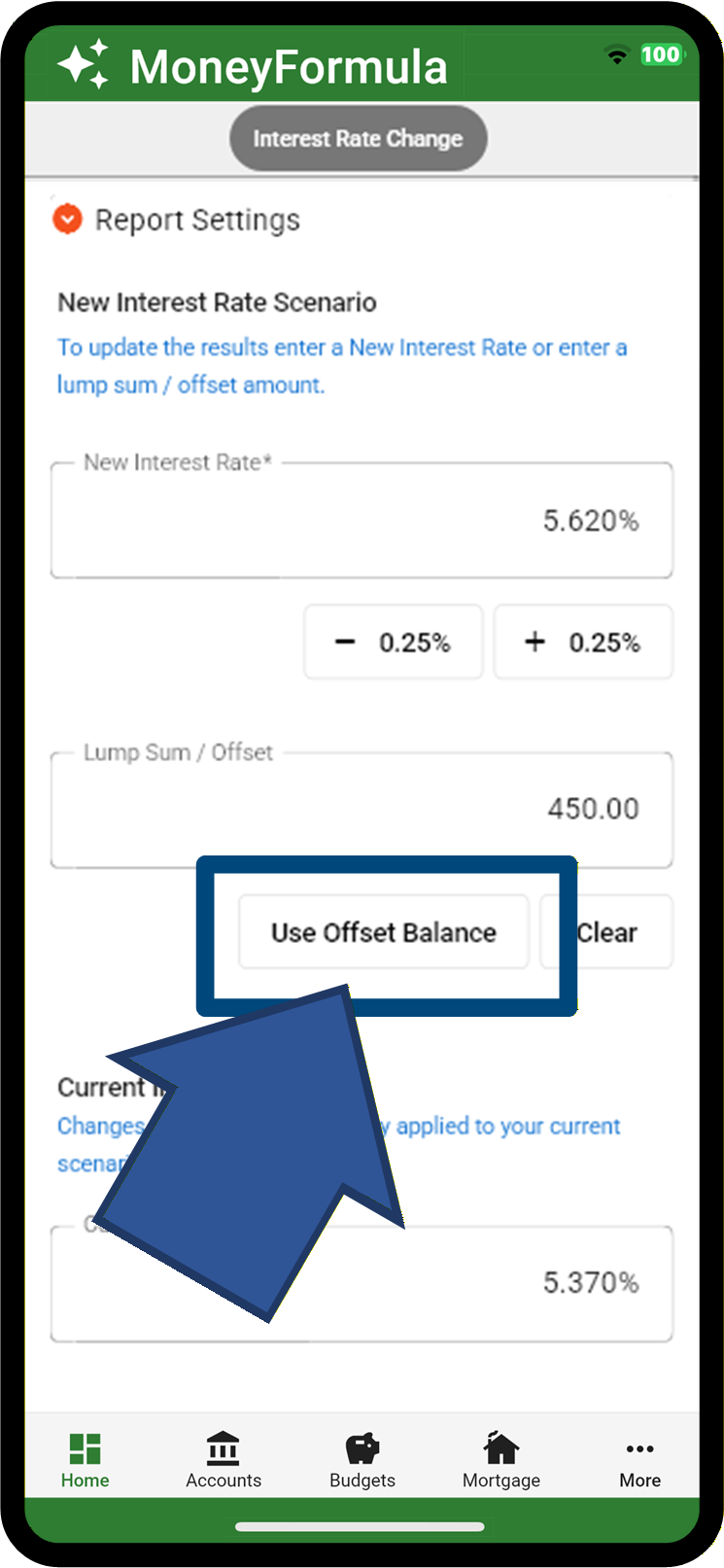

You can easily add your current offset account balance into the interest rate rise report above at a click of the button, or set the value to any future lump sum or offset amount you want to test, and see how much it will save you.

MoneyFormula App - Interest Rate Rise Report - Enter your offset balance or lump sum amount to calculate the impact.

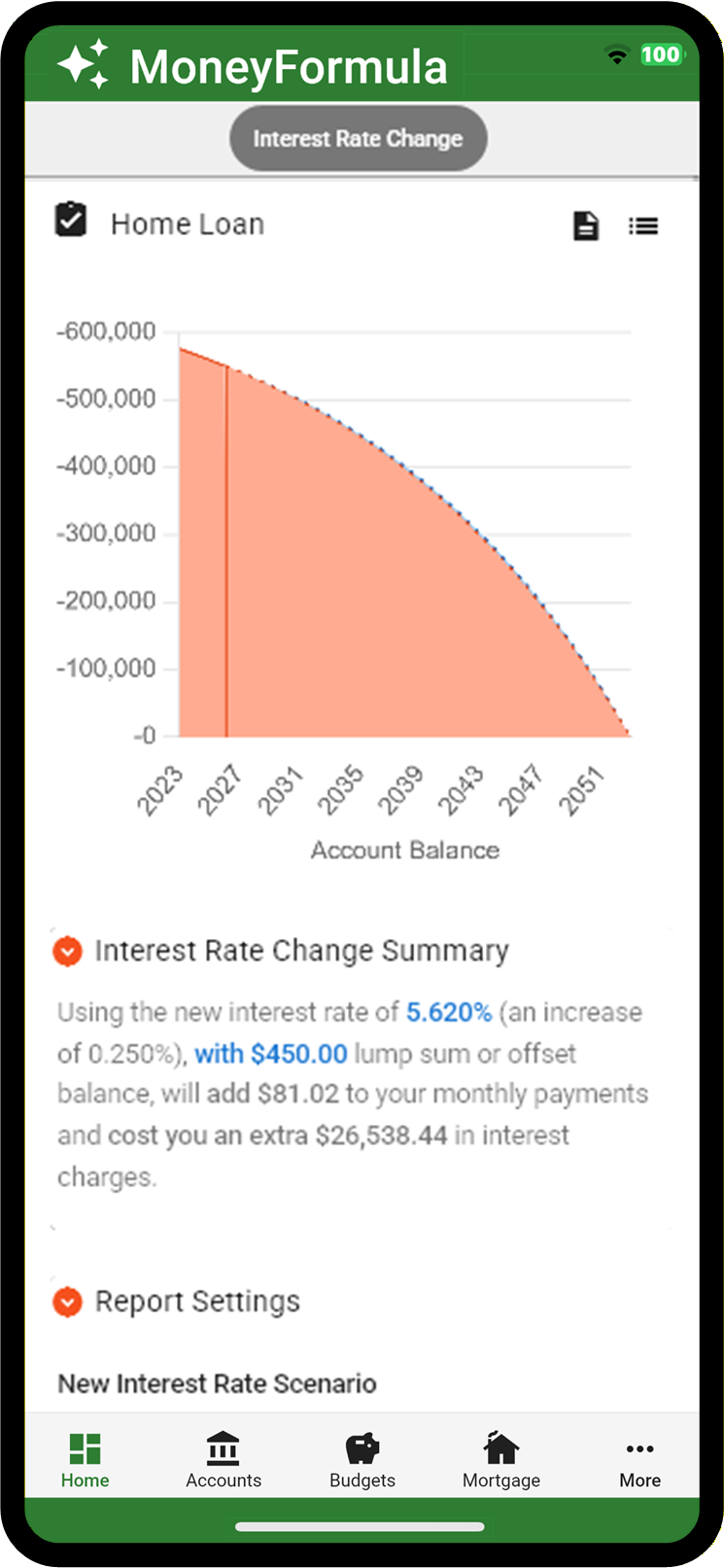

And the report will automatically update the summary and comparison to show the impact or your lump sum and offset amount.

MoneyFormula App - Interest Rate Rise Report - Enter your offset balance or lump sum amount to calculate your savings.

The screen above shows the $450 offset balance included in the summary, reducing the monthly increase from $83.73 to $81.02.

This is just on a $450 offset balance. The bigger the offset, the less you will notice the impact of the interest rate rise on your mortgage repayments.

Review Your Budget

Once you have calculated YOUR number, take a look at your budget and work out where that extra $90, $120, or $240 per month will come from? Find it now while you have time to adjust.

If you need help setting up a quick budget read the Five-Minute Budget article.

Review Your Spending

Review your last three months of spending and see if there are any additional subscriptions, waste, or expenses you could cut out if you need to. Start identifying where the $50 to $100 per month now could make all the difference.

If you need help with your first spending review check out the Quick Spending Review article.

Ready to Beat Your Next Interest Rate Rise?

Try the MoneyFormula Mortgage Tracker today and take the guesswork out of the next RBA interest rate rise!

Use the Interest Rate Rise report to instantly discover the impact it will have on YOUR mortgage repayments and then let the budget and planning reports help you find the amount you need.

Don't wait for the bank to surprise you. Give MoneyFormula a go today and take the stress out of your next rate rise!

Special Reports

Top Articles

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

15.

Show Less

PLEASE NOTE: The information in this article is general in nature. It does not take into account your personal objectives, financial situation or needs. Please speak to a qualified financial adviser if you need specific advice on your finances.