Top Articles by MoneyFormula: Australia's Best Mortgage and Personal Budget App for the Australian Household!

How to Use Your Mortgage Offset Account to Save You Money

Ever wondered how your mortgage offset account actually works and how it can save you money? It's simpler than you might think and it can be a powerful tool for building wealth.

Mortgage Interest Calculations

Most Australian lenders calculate the interest on your mortgage every day, by taking the mortgage closing balance and applying your daily interest rate.

Then each month your lender will add up all the daily amounts and charge you the interest you owe.

The Mortgage Offset Benefit

If you have an offset account, any money in the account is used to reduce the daily balance you are charged interest on.

For example, if you have a $600,000 mortgage and have $20,000 sitting in your offset account then you will pay daily interest on $600,000 - $20,000 = $580,000.

So every day you have money in the offset, it reduces the interest you pay.

Watch for the Offset Account Minimum Balance

Some offset accounts need to have a minimum balance before you receive a benefit. For example, your lender might have a rule that they will only include your offset balance in the calculations if it is over $1,000.

So if most of the month you have less than $1,000 in the account, you would receive no interest offset benefit.

Watch for the Offset Account Maximum Balance

Ok, this one won't be a problem for most of us, but worth mentioning.

If the offset balance is ever greater than the mortgage balance then you don't receive any benefit on the extra amount.

For example, if your mortgage is down to $100,000 and you still have $130,000 sitting in your offset account; then you won't be receiving any benefit on the $30,000.

The first $100,000 in the offset account is still working hard against the remaining mortgage balance, but the extra $30,000 is being wasted (and you might need to move this excess to a savings account or term deposit to receive interest).

What's the Catch with Offset Accounts?

The main problem with offset accounts is the lender will normally charge you for it in some way.

Some lenders only include it as part of a premium loan with higher rates or as part of a wealth package with a yearly fee; others might directly charge you a monthly fee to attach the offset.

So you have to make sure you are going to use your offset, and that you get enough benefit from it to cover the extra cost.

Offset Account Not Linked to Mortgage?

This one might surprise you; but sometimes the lender totally forgets to link the offset in their backend system.

They will set up the offset, you have a mortgage, they charge you for the offset - but they forget to link the two.

So you get ZERO benefit.

This doesn't happen too often, and if it does it is normally only in the early stages when loans and offsets are first set up, so a quick check of your interest charges on your first couple of statements is all you need.

Offset Account vs Mortgage Redraw

The alternative to using an offset is to rely on the redraw facility of your mortgage (if you have one).

If you make extra payments into your mortgage it will normally go against the principal amount and is listed as a redraw amount. Basically, you are ahead in your repayments so you can redraw the amount.

Some people simply use this instead of an offset as any amounts available for redraw reduce the balance you pay interest on; in the same way as an offset does.

However, a couple of extra points. Check that your loan allows extra payments and redrawing of amounts (especially if you are on a fixed rate as there could be limits).

Also, check that extra money is actually being applied to the principal and not just held in a separate account to be used for future repayments (as you won't get the interest benefit).

And, also check the rules on withdrawing and depositing extra money using your redraw. While offset accounts can often be used as transaction accounts; your mortgage redraw facility might need to be used less often.

If you are thinking of using your mortgage redraw facility, check with your lender and your loan contract to see what applies to you.

Is an Offset Account Worth It?

Now we've covered the basics, the real question is "is it worth it?" and "how much will I save?"

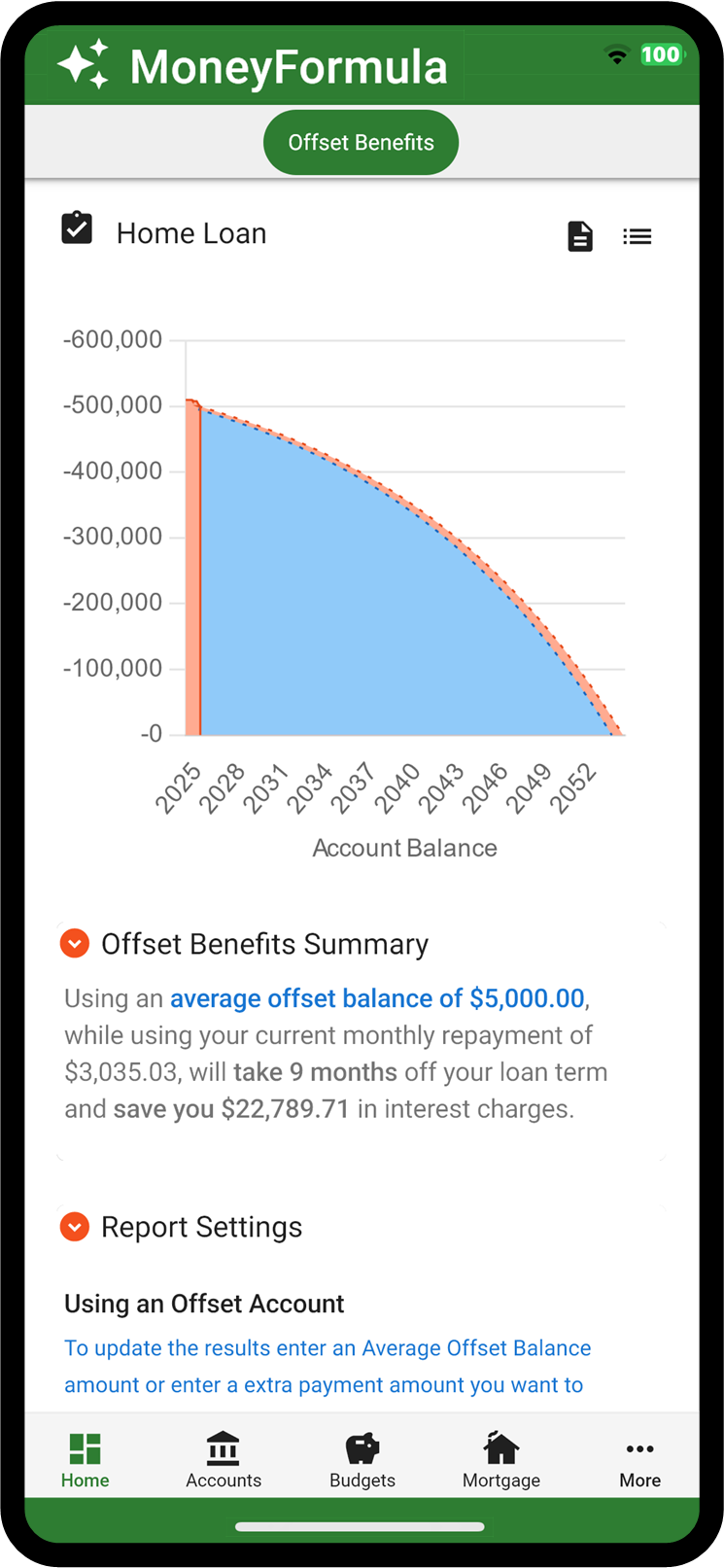

As a quick example, on a 30 year loan with a 6% interest rate; if you have a mortgage offset account with an average balance of $5,000 you would take 9 months off your loan term and save $22,789.71 in interest charges.

Side note, there are few ways to work out these calculations, but for the numbers above I just took the easy option and plugged them into the MoneyFormula Offset Benefit report to get the answer.

MoneyFormula App - Offset Benefit Report - 30 year mortgage with a 6% interest rate, average offset balance of $5,000.

To work out if an offset account is worth it for you, you will need to work out how much you think you will keep in your offset (on average); what your mortgage rate is; how long you have left on your mortgage and how much the offset is costing you.

Offset Account and Extra Payments

Any money in your offset is a good start, but the best results come from also making extra repayments into your mortgage (or building up your offset over time).

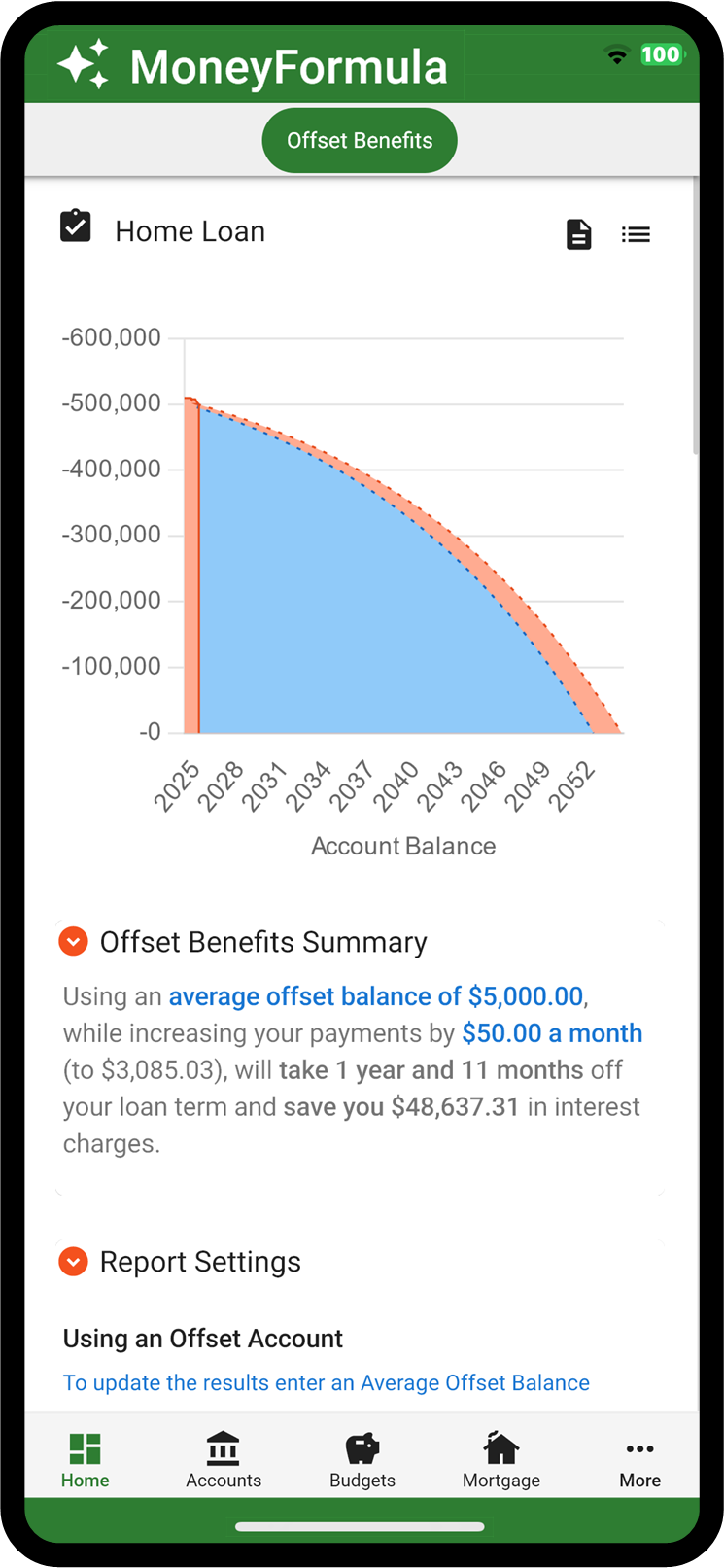

Using the example above of $5,000 in your offset; if you were to add an extra $50 per month into your mortgage (or offset) you would now take 1 year and 11 months off your loan term and save $48,637.31 in interest charges.

Again, I just plugged this into MoneyFormula to get the answer.

MoneyFormula App - Offset Benefit Report - 30 year mortgage with a 6% interest rate, average offset balance of $5,000 and $50 / month repayment.

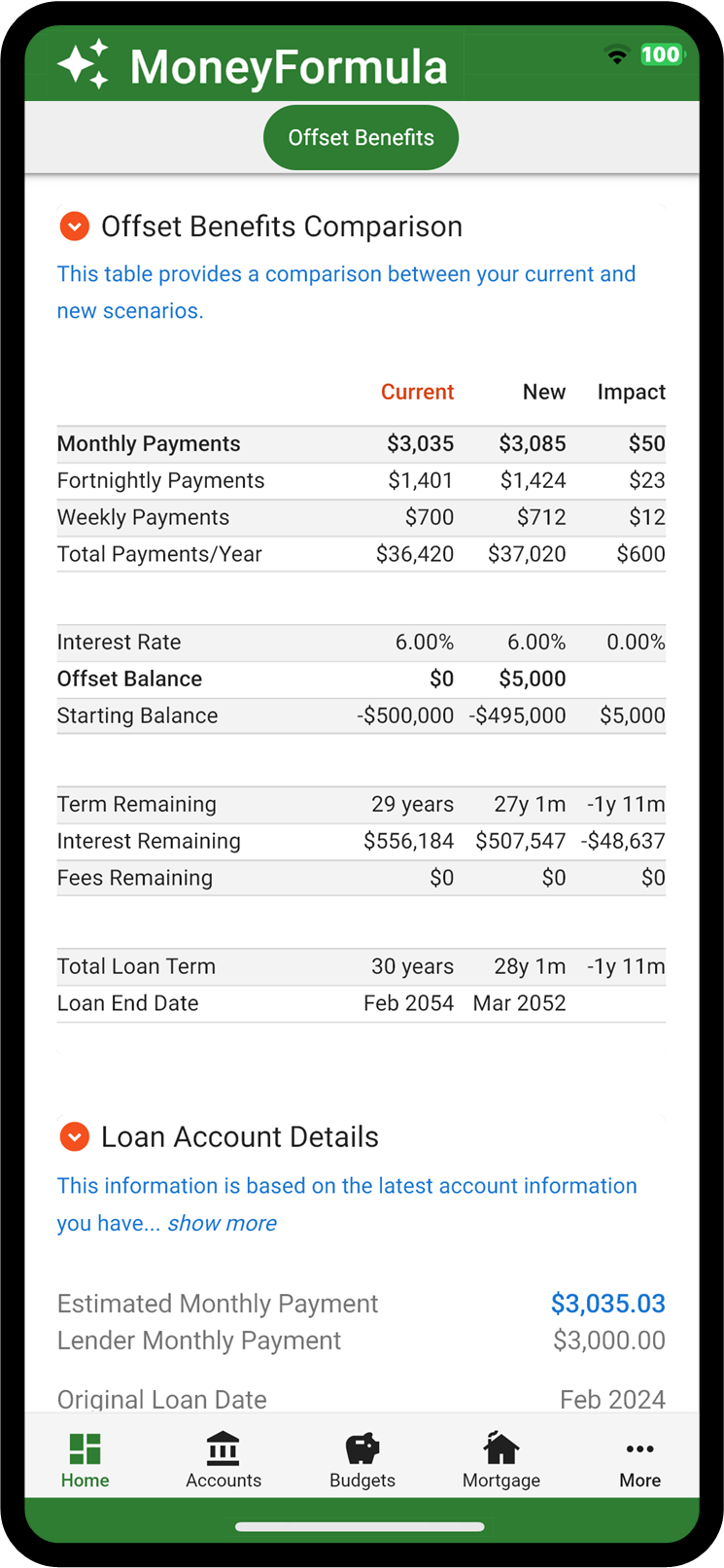

In case you want the details, here is the screenshot that provides the comparison table of the no offset (current) vs offset (new) scenarios with a complete breakdown.

MoneyFormula App - Offset Benefit Comparison Table - 30 year mortgage with a 6% interest rate, average offset balance of $5,000 and $50 / month repayment.

The Hidden Benefits of an Offset Account

There are a couple of extra benefits of keeping your savings in an offset account, instead of the alternative of putting money into a normal savings account or term deposit.

Offset accounts tend to have higher interest rates as mortgage rates are nearly always higher than savings and term deposit rates; so you earn more on your money.

Also, the savings you make using an offset account on your mortgage are tax free; whereas interest you earn on savings account are subject to tax.

For example, if you earn $100 interest on your savings account and you marginal rate is 30% you will lose $30 of the income.

I have covered this more in the Mortgage Offset Earns 3 x Savings article so check it out if you need more details.

How to Use Your Offset Account

One common way to use an offset account is to have your salary and income paid directly into the account each month. As we covered above you start receiving a benefit from the day the balance is updated.

Along with the offset, many people then use a credit card for all their monthly expenses (one with an interest free period).

So all expenses go on the credit card; the salary stays working in the offset account and then once a month you pay the credit card off in full.

A word of warning. A credit card is a double edged sword and when they go wrong they can go horribly wrong. Even if you aim to pay it off in full each month, but one month you miss a payment by one day it can cause huge damage in interest charges and undo months of hard work.

Good Money Management is the Key

Effective budgeting, smart spending habits and regular extra repayments are a great way to get the most out of your offset account.

It doesn't have to be complicated. One simple approach is to spend a little less every month, so that by default more stays in the offset and your benefit increases.

Want to find out how much you could be saving using your offset account?

Try the MoneyFormula Four Simple Steps today and discover just how easy it is to take control of your money, get the most out of your offset account and crush your mortgage!

MoneyFormula will help you budget smarter, review your spending and help put you in charge of your finances. It will even help you check your offset has been correctly linked to the mortgage and that you are receiving your full benefit.

Give MoneyFormula a go and get the most out of your offset today.

Special Reports

Top Articles

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

Show Less

PLEASE NOTE: The information in this article is general in nature. It does not take into account your personal objectives, financial situation or needs. Please speak to a qualified financial adviser if you need specific advice on your finances.